Insights

Are we about to see a correction in Perth’s property market?

Published

25 October, 2022

Panic and confusion. At the tail end of 2022, that’s what some headlines will make you believe is the tone of the Perth property market, with a correction on the horizon and real estate prices ready to plummet. We must be punished for the gluttony of expecting further capital growth, right?

But on what grounds are fear-mongers able to pitch their dire market theories? And what if these predictions aren’t even remotely accurate?

There are two types of investors currently occupying the Perth property market. Those waiting for the experts to tell them that it’s okay to invest. And those looking for the opportunities that will give them a strong foothold on one of the best buyer’s markets we’ve seen in decades – no matter what the headlines say.

We’re in the second camp, realising that significant opportunities to invest still exist, and believe that the time to stop buying high-quality Perth property – whether in the residential or commercial property markets – has not yet come. Here’s why we believe a market correction is not imminent for Perth, and why we think we’ll see many players soon return to the market.

1. Employment

Perth is seeing one of its lowest rates of unemployment since October 2008, with unemployment sitting at 3.163% as at August 2022. Not only is the job market bubbling with activity, while new overseas and interstate arrivals scour the job search engines, but Perth’s average wage is far superior to those on the east coast. The Australian Bureau of Statistics (ABS) says WA’s average annual ordinary time earnings (as of May 2022) is $100,724 per year, while the same figure for NSW is $93,080 and $91,000 even in VIC.

Our mining industry is certainly to thank, and as most of us have probably heard from our token FIFO mate, there is plenty of activity going on in the mining sector to keep unemployment low and salaries high for years to come.

All of this helps with mortgage repayments and the ability to put down a house deposit.

2. Rental market

Occupiers are seeing some of the toughest housing conditions in Perth’s history. And a quick trip to reiwa.com.au will prove it.

Today, without placing any filters into the property search engine, those searching for a home to rent only have 1,975 properties to choose from in all of WA:

What does this mean for property buyers? The first is that more property investors will consider attaining their second or third property to take advantage of high-yield opportunities from lucrative rents.

The second is that more renters will consider buying their first home, especially when the cost to rent is far outweighing the cost to own (yes, despite interest rates rising). Far more opportunities for finding a home exist in the buyer’s market:

This should bolster the call for the government to reduce building and subdivision red tape – as we’ve called for before – along with cutting tariffs like stamp duty, which only add to WA’s housing crisis.

3. Supply

Our last point says it all when talking of housing supply. There is simply not enough properties available in WA for rent or purchase to cater to the overwhelming demand in Perth’s property market.

Buyers are outnumbering sellers four-to-one in most suburbs, and this has the potential to worsen as more migrants arrive in Perth from other states and countries.

Housing construction – an activity that bolsters the economy twofold by supplying housing and providing jobs – has dropped off a cliff, while building and labour costs have pushed many builders and ‘mum and dad’ developers out of the market.

This does not bode well for the huge disparity between supply and demand. But it can put upward pressure on housing prices.

4. Housing affordability

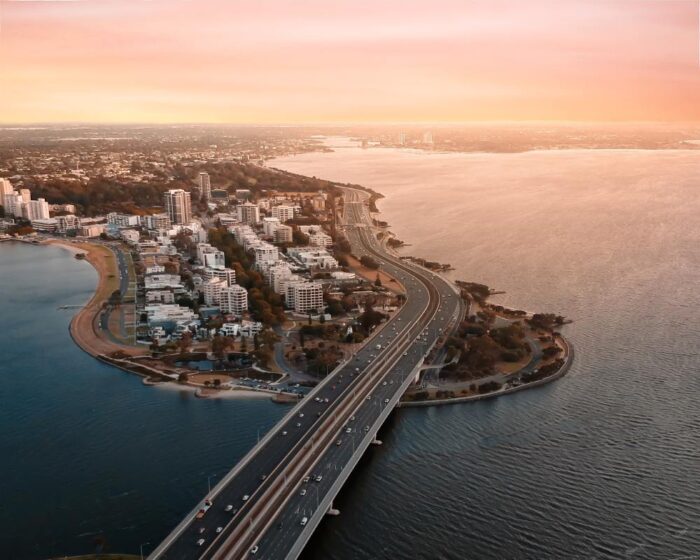

We also don’t foresee a housing correction just yet because housing is still considerably affordable in WA compared to other states. With a $585,000 median dwelling value, Perth is one of the most affordable capital cities to purchase a home in Australia. Sydney’s median value nearly doubles Perth, at $1,283,000, and even Brisbane far exceeds Perth’s, at $842,000.

Couple these numbers with Perth’s higher wages and stronger job market, and it’s easy to see why the foot traffic in WA is rapidly increasing, along with the demand for lodgings.

5. Interest rate rise affordability

Yes, interest rates are rising. But yes, West Australians can afford it.

The idea that the Perth property market is now toast because of several consecutive interest rate rises (don’t forget the cash rate is still considerably low, historically speaking) is one of the biggest overstatements we’ve heard all year.

According to canstar.com.au, the average monthly home loan repayment in WA as of October 2022 is $2,355. In NSW it’s $3,751. In VIC it’s $3,239.

Which means the average home loan repayment takes up:

- 28% of the average income in WA

- 48% of the average income in NSW

- 43% of the average income in VIC

I know which property market I’d prefer to be in.

The key strategy is to always be prepared

When COVID-19 hit – and we’re not blowing our bags here; just evidencing what good, strategic property investment looks like – our investors at Properties & Pathways didn’t lose a cent. There was uncertainty – plenty of it – and with new commercial leasing rules coming in hot every day from parliament it was hard to know how to react.

But we were prepared for COVID. We didn’t know it was coming, but with our relationships already intact with our dozens of nation-wide tenants and with our considerable reserve funds sitting in each property syndicate, ready to be utilised, we not only ensured our occupants had the best support available to see them through tough times, but we also ensured our investors were stress-free because we had a reserve fund to cater for any vacancies that may have arisen due to restrictions.

A correction, in our opinion, is not imminent for the Perth property market. Investment opportunities are rife in the residential – and commercial – sectors, and investors could do better than to sit on their hands while others prosper in the face of gloomy headlines – just as they did during COVID-19.

Want to be kept in the loop about our future investments? Subscribe to our mailing list for FREE property insights. We’ll be in touch every month with the news on the economy, the Australian investment landscape, and of course the evolving commercial property market.