Commercial

How a long-term investment can secure your retirement

Published

17 October, 2022

For many parents, putting a few bucks aside each week just won’t cut it if they want to spend their twilight years hitting the links or providing a lasting financial legacy to their kids. But thinking long-term, leveraging years of accumulated investment growth, might achieve that for them.

A long-term investment (depending on the investment of course) is likely to provide regular cash flow, either in the form of a dividend (if investing in shares) or yield (if investing in, say, property and receiving rental income). Cash flow is crucial for most passive investors. But in our opinion where the considerable fortunes or retirement funds can be made is in capital growth. Long-term capital growth, to be exact.

Why long-term capital growth?

A long-term capital growth strategy is for those looking to comfortably retire while ensuring their future generations will continue to prosper.

Speculative investors and overnight successes don’t fall into this group. While many millionaires and billionaires have had huge windfalls that placed them on rich lists, this is not the strategy for the smart investor. The smart investor has patience.

There are two major reasons investors will look for a long-term capital growth strategy:

You don’t have the assets to retire on

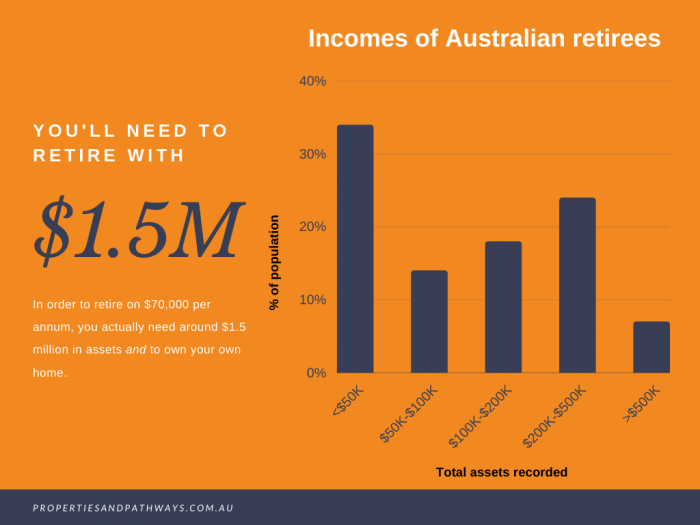

Did you know that in order to retire on $70,000 per year, you need around $1.5 million in assets? And you need to own your own home?

John L. Fitzgerald, author of Seven Steps to Wealth, says that only one in 100 of us Australians will have this minimum to retire on. And these figures are in today’s dollars. You can only guess what you’ll need to retire with in 20 years’ time. (Don’t guess, the answer is $150,000 per year and $3 million in assets based on 3 per cent annual inflation.)

Substantial schooling and university fees

Our kids’ education is up there with the most important things in life. Unfortunately, it is also up there with the most expensive.

To cover education costs, smart investors will create a long-term capital growth strategy to secure their kids’ education and at the same time maintain their own lifestyle.

What is a good capital growth return?

If you invested $400,000 at 10 per cent annual growth for 20 years, your investment would be worth $2,691,000

. Based on John L. Fitzgerald’s retirement plan, this would see you retiring quite comfortably in two decades’ time. (This scenario does not take into account capital gains tax, although CGT can be mitigated if you know how.)

Many property investments, especially commercial real estate, can provide annual capital growth of between 5 per cent and 10 per cent. CoreLogic reports the median house price in Australia has increased 412 per cent in the 25 years since 1993. That equates to annual capital growth rate of 6.8 per cent per year.

Commercial real estate, including industrial properties like this, can provide investors annual capital growth between 5 per cent and 10 per cent.

It’s certainly not for us to decide what is a good capital growth return for you. You should consult your financial adviser when making any major investment decision.

What sort of long-term capital growth investments?

If you want capital growth, you’ll be pegging your nose shut with these sorts of investments:

- Bonds

- Term Deposits

- Blue chip shares

“But what about shares?” you say. Well, unless you’re an experienced share investor with a diversified investment portfolio, you could do a lot worse than staying away from the ASX. See for yourself.

During COVID-19, ASIC recorded 4,675 new investors per day. New accounts made up 21.4 per cent of all ASX accounts in the 40 days after February 24.

How’d these new investors do? Very poorly. Share prices of the stocks they purchased declined on more than 26 of those 40 days. Those who sold shares during that 40-day period had just about as worse of a time. On more than half of the days that investors were net sellers, their dumped stock rose the next day.

Real estate

Property is the source of wealth for 90 per cent of millionaires worldwide.

And according to last year’s AFR Rich List, property remains the main vehicle by which fortunes are made, with 63 of the 200 entries earning their wealth from real estate. (Of the top ten entries, three of Australia’s wealthiest made their appearance on the list thanks to huge property portfolios.)

But it’s not enough to buy any old property in any old part of town. You’ll need to do your research. More on that soon.

Buy land for capital growth

If you’ve seen Tom Cruise in Far and Away, you might remember Cruise’s character Joseph Donnelly racing to stake his chosen plot of land in the famous Oklahoma Land Rush of 1889. The demand for such a valuable commodity was enough to risk life and limb – land ownership was a man’s “destiny”, Donnelly proclaimed – and that underlying demand still simmers beneath every property investor’s skin.

While building values will decrease in value due to depreciation, land values usually go up. This is because there is typically strong demand for a relevant piece of earth. Even to our ancestors, land is like gold, increasing in value over time (and by many investors’ judgement, land is a better investment than gold).

So, if you’re looking for a long-term capital growth investment, consider a property with a significant percentage of land content.

What else to look for in high-growth property?

When buying land for capital growth, do your homework and understand whether a property has strong capital growth potential.

Research the population and job growth in the area. Also, keep an eye out for vacancy rates. If vacancies are high but decreasing, this could be an opportunity to snap up a well-priced property in an improving area.

Investing in commercial real estate

Interestingly, many of the real estate moguls on the AFR’s Rich List divested from residential property and moved toward commercial real estate.

It’s no surprise. Even though commercial property is more popular for its yields of 5 per cent to 7 per cent (and higher), there are some huge capital growth opportunities for those who know how to add-value.

Here are a few examples of how to create value in your commercial property investment:

- Adding a new pylon sign to attract more foot traffic to your retail property investment. This keeps your tenant’s business activity high and rent coming in the door.

- Converting unoccupied space on your industrial property into hardstand.

- Negotiate a lease extension to your office tenant, say five or ten years long. You’ll likely see your property value skyrocket thanks to a guaranteed income for several years.

A new pylon sign on your retail asset can catch the eye of passing traffic and boost your tenants business activity.

To see long-term capital gains in commercial property, adding value comes at a price: Getting your hands dirty. That’s why many consider an unlisted property trust.

Why unlisted property trusts?

Also known as commercial property syndicates, an unlisted property trust is managed by experienced commercial real estate professionals who wear heart on sleeve to ensure your investment is looked after.

Here are a few more great reasons to consider investing in a commercial property syndicate:

- Better investment opportunities

- Leverage professional experience

- Improved finance options

- Lower overheads

- Set and forget investment

Some managers of unlisted property trusts will even invest with you in commercial property. This creates trust and transparency at every turn.

As successful commercial property investors, we prefer “time in the market” over “timing the market”. If you’re looking to increase your wealth and secure a comfortably retirement, why wait? Begin your long-term investment today.

Properties & Pathways is a commercial property investment company in Australia. We focus on yield over capital growth, but our properties have seen large capital uplift as a result of tactical investing. Get in touch today to find out how you can invest alongside us in exclusive commercial real estate investments.