Commercial

How Brisbane’s infrastructure boom will impact real estate values

Published

31 January, 2023

Queensland’s construction pipeline has exceeded $70 billion as of this writing, already having received a $1.47-billion infrastructure boost from the federal government in its 2022-23 Federal Budget. The reason for the focus on construction has a lot to do with Brisbane’s fast-growing population, its ability to bounce back from the pandemic, and its massive upcoming event in the 2032 Brisbane Olympic Games.

Infrastructure developments of course strengthens employment, unlocks economic growth for a city, and rapidly increases productivity for the precinct. Not to mention, it can have amazingly positive impacts on nearby property markets.

The impacts of infrastructure pipelines on real estate values

Let’s use Sydney as an example.

Between the announcement of the Sydney Olympics in September 1993 and the Games themselves in 2000, Sydney was Australia’s best performing property market with an average residential dwelling growth of 8.4 per cent per year.

That’s no accident, and we can prove it. Because a city doesn’t just need to be picked for the Olympics to see robust property market growth.

In 1993, the UK government spent £3.5 billion extending London’s Jubilee Line. That is £330 million per mile. By the time the train line upgrade was completed, property owners within a 40-metre radius of the line’s new stations gained a total of £13 billion. That’s a 3.7x increase in market values during the construction period alone.

So, what developments are actually happening in Brisbane to trigger its potential property market value growth? Let’s check them out.

Projects underway in Brisbane

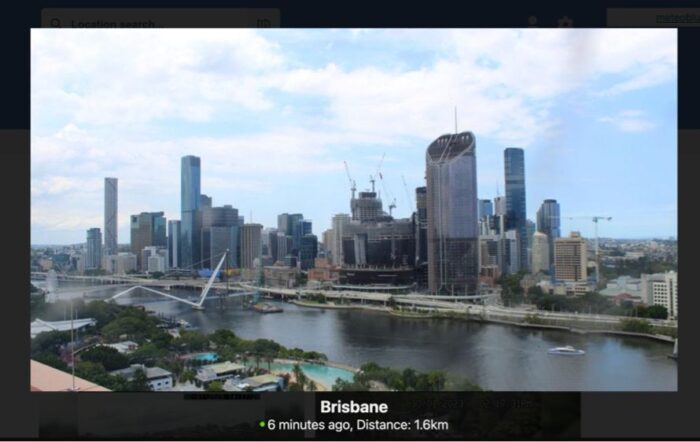

Years ago, my first employer told me that one way to understand the economic progress of a city is to count the number of cranes in its skyline. Well, as of six minutes ago, Brisbane’s CBD webcam is showing a tonne of them standing over its downtown buildings.

And there are many – many – more developments are going on in the outer ring of Brisbane, such as:

The 2032 Olympic projects: The two-decade pipeline of development opportunity will do wonders for Brisbane, with over $8 billion in benefits predicted from the development of huge projects in the leadup to the Brisbane Olympics.

For one, the athletes village in Northshore Hamilton will host more than 10,000 athletes during the 2032 Brisbane Olympics, and will later be home to a residential offering, aged care and retirement living centre post-Games. The 2032 Games will support almost 100,000 full-time jobs in Queensland. The benefits to the economy and relevant property markets will be huge.

Cross River Rail: The new 10.2-kilometre rail line from Dutton Park to Bowen Hills will also see several stations benefit from significant upgrades (including Salisbury, Rocklea, Moorooka and Yeerongpilly stations).

Brisbane Metro: The development of Brisbane’s first electric busway system is underway and expected to make its maiden journey at the end of 2023. This is a huge boost for the many nodes it will run through, including Eight Mile Plains, Mt Gravatt, Nathan, Holland Park and about a dozen more precincts.

Brisbane Live: A whopping $2-billion entertainment complex will be constructed on Roma Street in Brisbane’s CBD. The arena complex has been designed in the style of Maddison Square Garden, with a 17,000-18,000-seat capacity.

Victoria Park: The closure of Brisbane’s only inner-city golf course has paved the way for a Central Park-style park redevelopment (yet another New York-inspired development… See the pattern yet?).

Queen’s Wharf: The spectacular Queen’s Wharf development, a $3.6-billion demolition and redevelopment, will be waterfront resort with hotels, apartments, restaurants and even a casino.

The list goes on and on, and I’m sure by the end of the fiscal year, there’ll be even more developments to talk about.

Queensland property boom expected

Property prices in southeast Queensland are expected to catapult in the leadup to the 2032 Olympics. It’s happened in Sydney over two decades ago, and it’ll happen again in Brisbane.

There’ll be a considerable amount of new residential supply injected into the property market once the Games are completed, with the athletes village creating new residential, retail and commercial premises opportunities. But the suburbs that will be positively impacted is far from limited to just Northshore Hamilton. House prices should see huge positive growth in Tennyson, Chandler, Wooloongabba, South Brisbane, Redland Bay, and even as far as Coomera.

Job growth is one of the main factors for this price growth, as it helps more buyers into the market, creating competition, reducing supply and putting upward pressure on property values. Housing demand will play a huge factor in Brisbane’s property boom, of which its reality – we’re sure – is more a matter of when than if.