Insights

Why Perth’s CBD Office Market is the brightest in Australia

Published

05 December, 2023

When it comes to office real estate markets in Australia, Perth’s CBD is standing out as a top performer nationwide, according to Knight Frank’s September 2023 Perth CBD Office Market Report.

WA’s capital has been making waves with its impressive numbers and unique market dynamics – even if most national headlines are still missing the scoop – and in this snapshot, we’ll expose what makes Perth’s CBD office market a destination worthy of investor capital.

Want to dive even deeper into Perth’s burgeoning office market? Get your FREE report on the Perth CBD Office Property Market here.

Strong, positive absorption

One of the most impressive features of Perth’s CBD office market is the remarkable net absorption, particularly in A-grade office spaces. Why is this important? Positive absorption shows that more office space is being leased or purchased than is being vacated, and gives us a significant understanding of the market’s health and performance.

This segment witnessed significant growth in the last two years, totaling a substantial 36,539 square meters. And this continued in H1 2023, with 23,950 sqm recorded. That’s a total of 90,534 sqm of net absorption in a little over two years, reflecting 4.9 per cent of total stock – the second highest positive absorption rate of any major CBD since 2021.

This is a stark contrast to other major cities, where what little absorption exists has been concentrated primarily in premium-grade assets.

Rising Prime net face rents

Right now, Perth CBD’s leasing market is very active, and it takes only one look at the market’s net face rent increases to see it.

Prime net face rents in the area have increased by 1.5 per cent in just six months, reaching an average of $678 per square meter. And if any more proof was over the past year, rents have surged by 5.3 per cent, making it one of the fastest-growing markets in the country.

Slight increase in vacancy rates – but for good reason

It’s worth noting that the overall vacancy rate for Perth’s CBD experienced a slight uptick, rising by 0.2 per cent in the first half of the year, resulting in a 15.9 per cent vacancy rate.

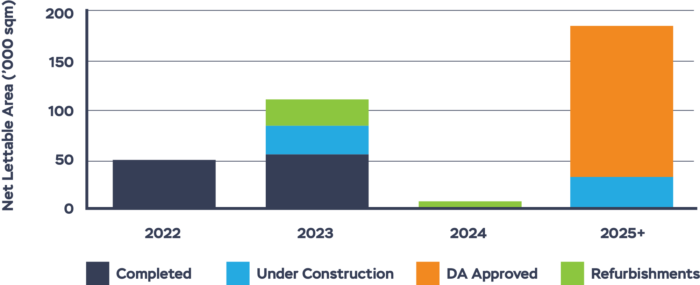

But this increase is owed to high supply additions in the area. 2023 has seen considerable office space come online in Perth’s CBD. But that supply drops off a cliff in 2024, with virtually zero sqm in additional space. 2025 and beyond includes primarily DA approved buildings. This low supply forecast means the 2023 vacancy rate is, perhaps, as high as it’ll get for some time.

When it comes to premium-grade office spaces, Perth’s CBD stands strong, with a vacancy rate of only 6.3 per cent, second only to Brisbane nationally.

Low sublease vacancy rates

While many office markets across Australia are grappling with higher sublease vacancy rates – likely owed to businesses allowing more flexible work arrangements and opting to lower their premises’ footprint – Perth is a standout exception. In Perth’s CBD, sublease vacancy rates have actually decreased, sitting at a mere 0.5 per cent. As we’ve said in our recent report on the Perth CBD Office Property Market, Perth is running its own race.

Significant demand

There is consistent and exceptional demand for office spaces in Perth’s CBD. Knight Frank’s Head of Office Leasing in WA, Rick McKenzie, points out why:

“While the premium vacancy rate will increase as a consequence of backfill and further completions, demand here remains the strongest of all grades.”

How to take advantage of Perth CBD’s promising outlook

Looking ahead, the future of Perth’s CBD office market appears promising. With no completions scheduled for 2024 and limited supply additions expected in 2025 and 2026, the market has a stronghold on its current impressive position. And that’s going to put many interstate and international investors in line for high-quality acquisitions in the coming years.

Looking to park your capital in high-quality WA office property investment, but don’t have the time, expertise or capital to go it alone?

Commercial real estate syndicates have made investing both easy and exceptionally profitable for many Australian investors. Syndicates pool together the funds of similarly-minded investors, and use the expertise of real estate professionals to ensure sturdy passive income and stable capital growth for years to come.

Get in touch today for a no obligation chat about what Properties & Pathways offers its investors, and how we can help you on your journey to secure a healthy retirement.