Australia’s top 20 super funds recorded negative returns in 2022 (but commercial property didn’t)

Published

February 13, 2023

Published

February 13, 2023

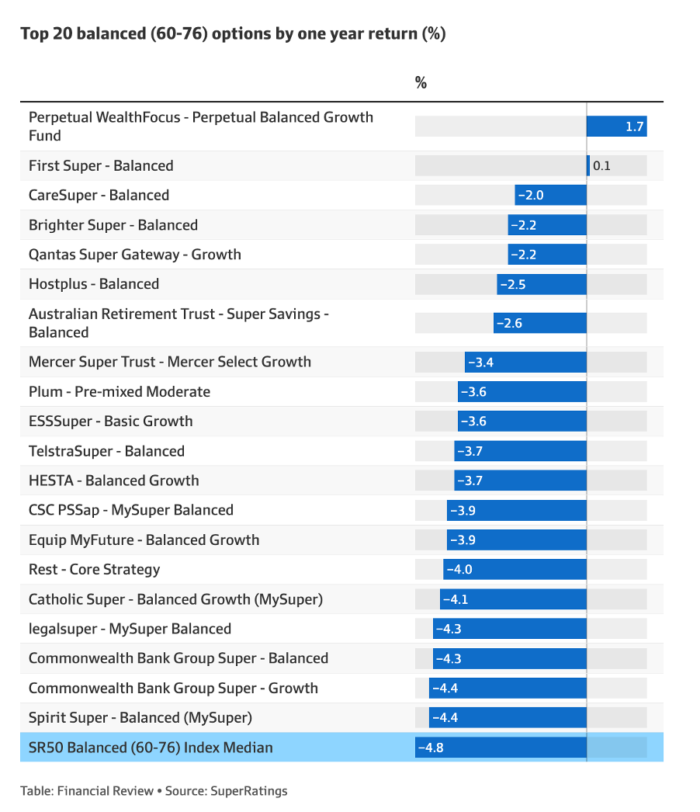

The average return of balanced super funds in 2022 was negative 4.8 per cent, and only two super funds made money for their investors. But the strongest performing super funds (even if they posted a loss in 2022) were the funds with the highest exposure to unlisted property.

Returns are currently tight across a spread of investments, but do those nearing or in retirement need to settle for negative returns? We don’t think so.

Why the top 20 super funds performed poorly in 2022

A lot of superannuation funds became very defensive in 2022, pushing their funds into both bonds and cash investments. Cash provided a 0.1 per cent return in FY22, while in the same period, Australian bonds rewarded investors with a negative 10.5 per cent yield.

This helps explains the underperformance of every single Australian super fund in 2022. But of course, there’s typically decent exposure to the share market, too. And yes, another bullet to positive returns came from the stock market. The share market’s weakness pulled down super performance considerably, as we’ll soon see.

2022 was the first time in 11 years that many of Australia’s super fund members would’ve seen a negative return.

What about shares in 2022?

According to the AFR, most top super funds still managed to outperform share markets in 2022. But this isn’t exactly comforting news for investors. We’re also not so sure how true that is…

The 2022 Vanguard Index has Australian stock market returns sitting at negative 7.4 per cent for the 12 months to 30 June 2022. A whole lot worse than international shares, which achieved negative 6.5 per cent for the same period.

Investors should very well know the volatility of the stock market if that’s where they’re looking to invest. Shares can provide overnight blockbuster gains as well as overnight life-changing losses. While risk is everywhere in the investing world, an investor’s appetite for it and their ability to withstand heavy losses should determine where and how much they invest their money.

For us, we like commercial real estate. Its ability to maintain value over long periods of time, without sudden drops in price or market fluctuations, gives us the comfort we need to focus our time on it.

How did commercial real estate perform in 2022?

Bucking the trend of negative annual returns in 2022, commercial real estate performed well for Australian investors. Investors in office, industrial and even retail properties would’ve most likely achieved net yields between 5 per cent and 7 per cent in 2022.

Yields did tighten compared to 2021, and that was certainly felt with rising finance costs, but as you’ll soon see, commercial property investors’ hard-earned capital was better off from one new year to the next.

Commercial real estate can be for passive investors. That’s why more retirees, SMSFs and family offices are turning toward the investment class. Speaking of passive investments, Hostplus’s Indexed Balance Fund – a passive investment fund recommended by author Scott Pape in The Barefoot Investor – was making a 5.7-per cent loss at the end of FY22.

Why consider commercial real estate over super funds (or at least diversifying)?

Commercial real estate investment can be known for its jaw-dropping yields. Investors might typically expect annual returns of between 5 per cent and 8 per cent, and even far higher with the right investment. These returns usually trump residential property yields, which usually only tempt cash flow-hungry investors with 1 per cent to 3 per cent annual returns.

For perspective, I don’t see any reason why we shouldn’t share our results with you for the year.

We’re a commercial property syndicator. We pool the funds of dozens, if not hundreds, of sophisticated investors to go after high price tag unlisted assets. In 2022, the investor cash return we provided our investors was 7.70 per cent. This has bolstered our ongoing annualised internal rate of return of 21.97 per cent.

It’s not by accident. We’ve been posting strong yields for over ten years, and even provided huge returns when the pandemic first hit. Of course, past performance does not guarantee future returns, but we stand by our strategy, our immense due diligence and our expert management for every property investment.

Want help investing in commercial real estate? We’ve provided our investors with reliable yields for over a decade. Get in touch with us today to learn about our upcoming syndicated investments and how you can invest alongside us in a secure passive property investment.