Perth property boom makes WA an investor’s gold mine in 2021

Published

March 2, 2021

Published

March 2, 2021

The nightmare that Perth’s residential market was meant to have during COVID-19 never quite came. Instead, Perth property sales hit their highest level in seven years, with established home sales 29 per cent higher Y-o-Y in the three months to November 2020.

Meanwhile, the rental market is putting big smiles on landlords’ faces thanks to a major rental shortage.

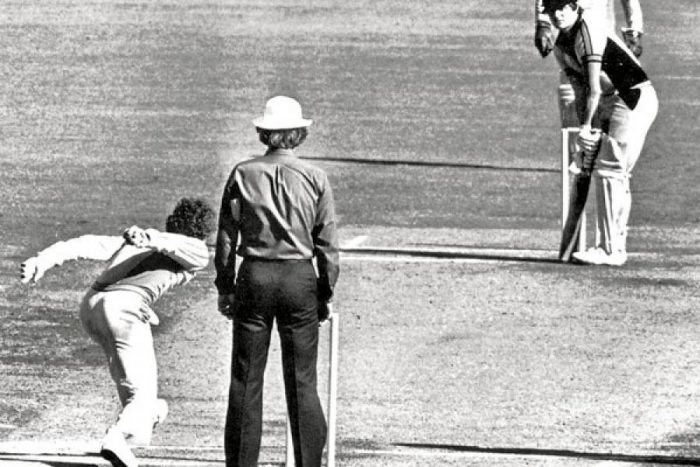

The residential vacancy rate sits at an unbelievable 0.9 per cent as of this writing. The last time vacancies were this low, Malcom Frazer was our PM and Trevor Chappell bowled his famous underarm against New Zealand at the MCG.

The residential vacancy rate sits at an unbelievable 0.9 per cent as of this writing. The last time vacancies were this low, Malcom Frazer was our PM and Trevor Chappell bowled his famous underarm against New Zealand at the MCG.

A unit in Beckenham (a suburb in Gosnells which has undergone significant urbanisation) saw 800 enquiries by prospective renters, and at the same time reports warned renters to brace for a 20 per cent hike in rent once the rental ‘price ban’ lifts on 28 March 2021.

Q: What ‘price ban’? A: The Residential Tenancies (COVID-19 Response) Act stopped evictions and put a freeze on rental hikes until 28 March 2021.

The impact on property values is likely to be significant. Especially for the thousands of homeowners whose home or investment hasn’t moved for a decade. ANZ says Perth will be a standout performer with 12 per cent growth expected for 2021. This is well ahead of the 7.8 per cent predicted for Melbourne and the 8.8 per cent growth for Sydney.

How has Perth become a goldmine for property investors in 2021?

Tightening of supply and a sudden flock of buyers has led Perth into its hottest residential property market in nearly a decade because WA has become a buyer’s “safe haven”.Transaction levels are higher than the last residential boom, at nearly 950 sales per week (the last boom in 2013 peaked at 850 per week), and that’s largely due to a combination of:

1. WA residents returning home from interstate and abroad

Due to the largely uncertain nature of international travel, it’s expected these are not mere visits by former WA residents. These members of the Perth population are returning home for good.

2. WA’s renewed confidence in its real estate market

With affordability still high enough for first home buyers to join the market, and both luxury markets and key infill locations drawing those buyers with an eye on local amenity and upcoming infrastructure projects, WA is brimming with confidence in what 2021 will bring for its residential real estate market. Experts tip this will continue for the foreseeable future

3. Counter-cyclical investors eyeing off Perth real estate

Perth’s median residential property price has hovered around the $500,000 mark for over a decade. Many Perth property pundits have expected the price to lift for years, but all the right ingredients have not necessarily been available for the market to actually heat up. Western Australia is poised for recovery after ten years in stagnation. So, while property prices are still relatively affordable and the expectation is for values to skyrocket, Perth is an ideal target for counter-cyclical investors.

4. Historically low interest rates

It’s property economics 101: Interest rates are a major factor in property cycles. When high, investors will only buy property if they can afford the huge repayments, or instead keep their money in well-rewarding deposit facilities or purchase high-yielding bonds. When interest rates are low, buyers jump in the real estate market, armed with affordable mortgage repayments. Perhaps even more affordable than paying rent to a landlord.This is what Perth is seeing right now: Bottomed-out interest rates and more people taking out home loans to buy houses. Want proof? Look to the leading indicator of housing demand; property finance. It’s pretty easy to see why WA is one of the hottest property markets in Australia right now. Finance is up 71.3 per cent for the year in WA.

5. WA’s resource-led economy

The same sector which created and vacuumed Perth’s last property boom will be the catalyst of the next. Perth’s mining sector is moving up a gear, as iron ore prices skyrocket and annual export revenue breaks records – and neither shows any sign of slowing down. 2020 saw iron ore’s annual export revenue hit $116 billion compared with $96 billion in 2019. This is owed to China’s swollen demand for iron ore, with booming iron prices expected to add $2.3 billion to WA’s coffers over the next four years – bringing the WA state budget into surplus.  China is the world’s biggest steel producer and relies on imports for nearly 80 per cent of its iron ore. While the Australia-China trade relationship has recently soured, and concerns exist around the economic powerhouse shifting imports to other mines (like Brazil and even their own low-grade resources), WA will still likely remain China’s largest trading partner for the resource. This is due to WA’s immunity to COVID-19, the supply disruptions from Brazil, and China’s recovering steelmaking industry needing resources now.

China is the world’s biggest steel producer and relies on imports for nearly 80 per cent of its iron ore. While the Australia-China trade relationship has recently soured, and concerns exist around the economic powerhouse shifting imports to other mines (like Brazil and even their own low-grade resources), WA will still likely remain China’s largest trading partner for the resource. This is due to WA’s immunity to COVID-19, the supply disruptions from Brazil, and China’s recovering steelmaking industry needing resources now.

What does this mean for Perth commercial real estate in 2021?

Residential and commercial market reports are chalk and cheese. But when us commercial property investors hear of good news in the residential property market, there are many reasons why we get excited. This is because key drivers of residential real estate are closely aligned with those drivers that push the commercial market. In fact, in many instances, these drivers are the same. While WA investment capital has become weary of ‘false starts’ of a Perth property market recovery, the reality is there is a significant and growing weight of capital seeking to be placed in WA property. And the same goes for commercial property. The confidence behind the uptick in pace has been a long time in the making and commercial real estate values will benefit greatly from the throngs of investors (both domestic and foreign) re-entering the market.

Want an investment you can trust?

Consider investing alongside an experienced property investment company with a reinvestment rate of 91 per cent. Get in touch to learn more about our current commercial property investments.