What makes the best countercyclical investment?

Published

November 30, 2020

Published

November 30, 2020

Updated: 2 September 2025

A significant portion of the commercial properties we analyse are counter?cyclical investments. These opportunities consistently deliver strong returns—and it’s no accident. Our expertise, rooted in detailed, experience?driven analysis, reveals why they perform so well.

We have an unwritten checklist of what commercial property investments are countercyclical, and we also ensure we are chasing the right properties. But they’re not as simple to find as many think. Just because these investments sit in countercyclical markets doesn’t mean they will prosper in years to come.

What do we mean by a “counter?cyclical investment”?

In real estate, this refers to properties or precincts positioned near the market bottom—often overlooked and undervalued. But—and this is key—through rigorous local insight and strategic due diligence, we identify those poised for a rebound. Our data?backed approach ensures you’re investing at just the right moment to capture upside.

It’s six o’clock on the property clock

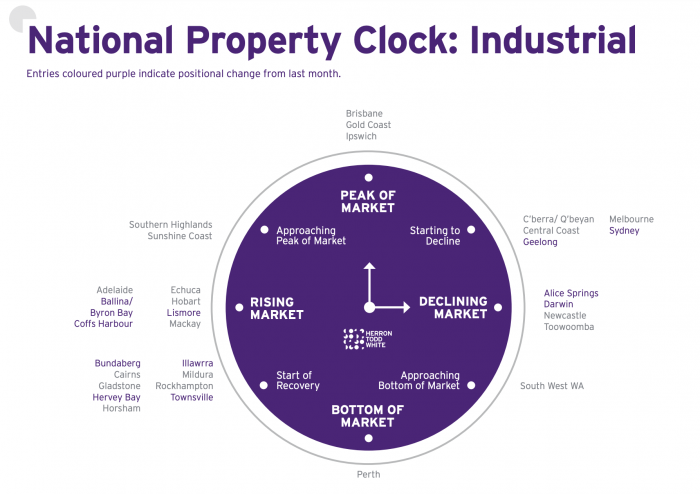

Ever heard of a property clock? It’s a tool many property investors use to understand where certain property markets are at in the real estate cycle. Here’s a recent one from Herron Todd White:

- Source: HTW, https://static.htw.com.au/HTW-month-in-review-November-2020-Commercial.pdf

The market might be at its peak (expensive property, in low supply and/or high demand), at the bottom of the market (where there’s only one way to go), or somewhere in between.

A property clock is brilliant for us countercyclical investors to help us find our next investment. Because the first rule for finding the best countercyclical investment is knowing where a property (or location) is in the property cycle.

When a property market is at “six o’clock” – i.e. the hand is pointing down, to the bottom of the market – the market is at its lowest. Typically, prices are too.

Not just that, but the forecast is for that market to begin heading upward. That means you can – again, typically – buy a property at its lowest and enjoy the upswing in value when the market begins to turn for the better.

More than one reason for capital growth

It’s prudent to rely on more than just one indicator when considering whether a property will achieve solid capital growth in the future. The property clock is great, but you’ll want more certainty before pouring millions of dollars into your countercyclical property investment.

So, take a look at the other factors which will influence the countercyclical investment’s capital growth:

Local infrastructure

Want to know where the next top suburb is likely to be? Follow the infrastructure spend.

Governments have access to bootfulls of information which point them toward precincts which deserve the most attention. They then foot the bill for huge developments in the area.

Some pundits even say to look for the cranes in a region. Cranes indicate a growing population and new employment for an area. Both great things for commercial property development and investment.

Flight to quality

A real estate market might be experiencing ugly times. But you’ll want the promise that tenants will resume their interest in the area.

The term flight to quality is common among real estate investors. A flight to quality occurs when property prices are so low in an otherwise desirable area, that businesses will pull up stumps in their existing premises and upgrade to a far better one while rents are affordable.

This tenant demand is one of the early indicators that the property market is returning to strength.

Leasing and market trends

Some retail property markets are losing value due to loss of relevance in an eCommerce-fueled retail world. Just because these markets are at the bottom of the market, does not mean they’ll be ticking upwards to 12 o’clock anytime soon.

On the other hand, office property and industrial real estate are seeing more and more relevance thanks to many growing businesses. These asset classes will be hunted for years to come.

Gentrification

A property market may not be in a state of decline or even a state of recovery. It may be gentrifying.

Gentrification occurs when an undesirable precinct rapidly becomes a desirable one. Values turn from low to high in a very short time. Sometimes it’s even hard to remember what an area was like before it gentrified.

Gentrification typically has the government to thank, which introduces new development and infrastructure projects to the area. This in turn produces jobs, tighter housing markets, local amenity, and an increase in local population.

Buying in an area that has good reason to be gentrifying can typically produce a brilliant countercyclical investment.

Momentarily mispriced due to external shocks (e.g. COVID?19 or similar downturns)

Market?shaking events—like the COVID?19 downturn—can temporarily suppress investor activity, creating rare openings for disciplined syndicators. When headlines and headlines-only thinking drive widespread hesitation, that’s where opportunity lies for those prepared.

Take Melbourne’s logistics sector post?2020 lockdowns. While many backed off, we saw resilience: surging e?commerce volumes made logistics hubs highly sought after. We moved in, securing prime assets delivering outsized capital growth as the market rebounded.

Curious to explore Australia’s next emerging commercial precinct? Contact us today—we pride ourselves on transparent, investor?centric conversations.

Prefer to stay informed at your own pace? Join our community of 3,000+ subscribers receiving monthly expert insights grounded in real?world success.

Content by Dave Sonntag Written